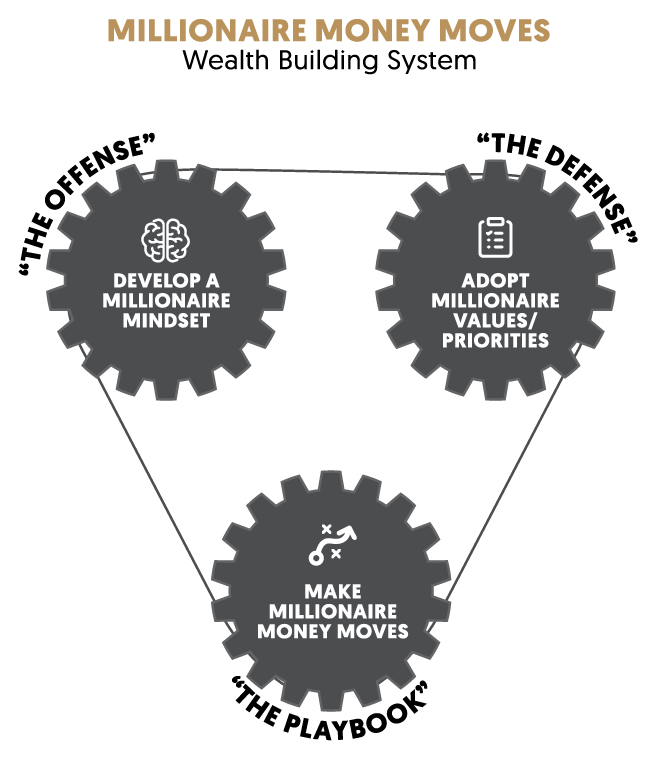

The Millionaire Money Moves Wealth Building System

Millionaire Money Moves (M$M) is my proprietary wealth building system. It was designed to mobilize your income and help you build wealth through the transformation of your income into assets that appreciate and generate income.

My M$M system is for everyday workers who don’t represent the top 1% of income earners nor the highly connected with access to significant startup capital. It’s for well-intentioned folks who want to become a millionaire starting from the bottom.

Most personal finance approaches are piecemeal and fail to create a continuum for creating wealth. Perhaps unsurprisingly, traditional personal finance advice rarely succeeds in building wealth, let alone generational wealth

My M$M wealth building system is made up of three components.

1. Developing a millionaire mindset – “The Offense”

2. Adopting millionaire values/priorities – “The Defense”

3. Making Millionaire Money Moves – “The Playbook”

Wealth-Building System Quick Links

Developing a Millionaire Mindset

Your mindset is made up of your preconceived ideas, beliefs and practices. These are often based on what we’ve been told by people we respect (parents, mentors, teachers, community and religious leaders).

Throughout our lives, our mindsets are programmed and developed based on our lives and cultural experiences. My Millionaire Money Moves system advises you on how to transform your present mindset and money values into those of a millionaire, thereby opening the door for you to make millions.

Developing a millionaire mindset is the offense because the way you see things impacts your willingness and ability to achieve what you want in life. You’ll find that those who possess a millionaire mindset have the knack and desire to find and seize financial opportunities. It all starts with how they’ve learned to think.

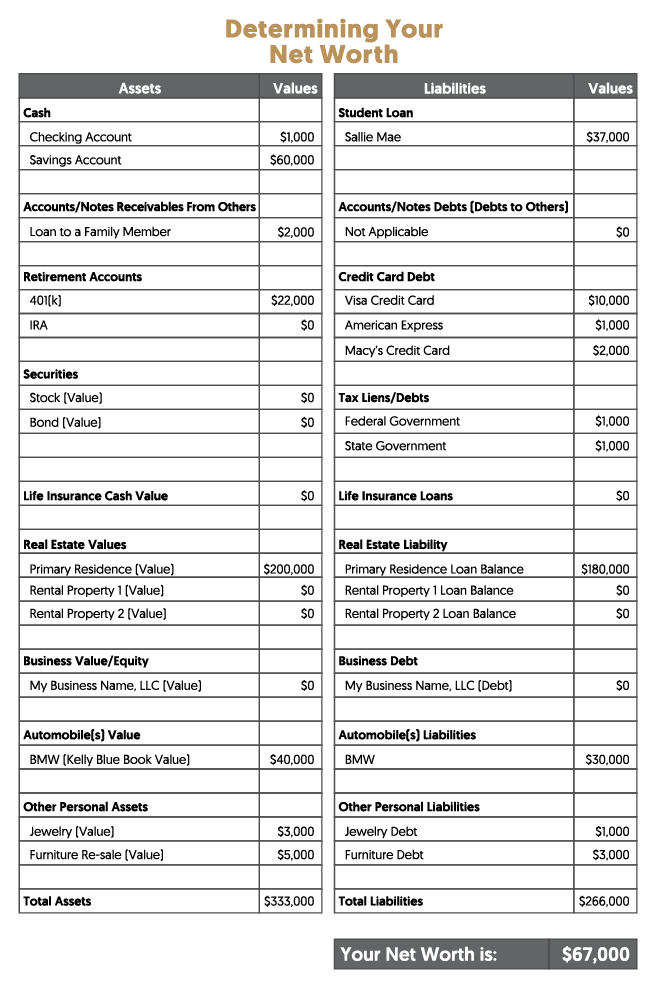

Determining Your Starting Point

The first step in my M$M wealth building system is to figure out your starting point. It’s impossible to achieve any positive result nor to arrive at a specific financial destination if you’re not clear where you’re starting from. Because the M$M system’s objective is to make you a millionaire, meaning a person with at least $1M of net worth, it’s essential to always know your net worth and to track it along your wealth building journey. Your current net worth or level of wealth is measured by adding the sum of your assets, then subtracting the sum of your liabilities. Assets are tangible items that hold value (cash, stocks and bonds, single-family properties, multi-family properties, commercial properties, owned businesses, alternative investments, etc.). Liabilities are made up of debt owed to others (mortgage balances, credit card balances, car loan balances, tax liens, etc.)

When it comes to liabilities it’s important to distinguish between “bad” and “good” debt. Bad debt is associated with things that lose their value over time (clothing, travel, cars, furniture, etc.) Good debt refers to assets that appreciate, generate income, and lead to higher income over time (student loans, business loans, mortgages to purchase single-family, multi-family and commercial properties, etc.)

To increase your net worth you must invest in quality assets as you eliminate any and all bad debt. Taking on as much good debt as you possibly can should be seen as a positive step because it indicates that you’re acquiring more appreciating assets, which in turn increase your income and make you wealthier.

To become a millionaire your net worth/level of wealth (the sum of your assets minus the sum of your liabilities) must be greater than or equal to $1 million. I’m confident that anyone regardless of age, race, income, or starting point can reach Destination Millionaire and beyond if they’re willing to put in the work, stay focused, and intensively commit to investing in assets that appreciate and generate income.

What’s the point of all this, you may wonder? The true purpose of acquiring significant wealth is to provide you with income for the rest of your life so that you don’t have to work for it; instead, your assets do the work for you. This gives you the financial freedom to dedicate your gifts and talents to whatever work or leisure you desire without having to be concerned about how you’re going to survive financially.

My M$M Wealth Building System specifically requires you to study, measure, and understand the impact to your net worth of every money move you intend to make – prior to making it. This type of careful forethought guarantees that your level of wealth will continue to grow. In turn, by teaching this process to your family (siblings, children, and grandchildren), you’ll be able to successfully pass your wealth forward to the next generation so that they can grow and reap the benefits of your wealth and pass it along to subsequent generations.

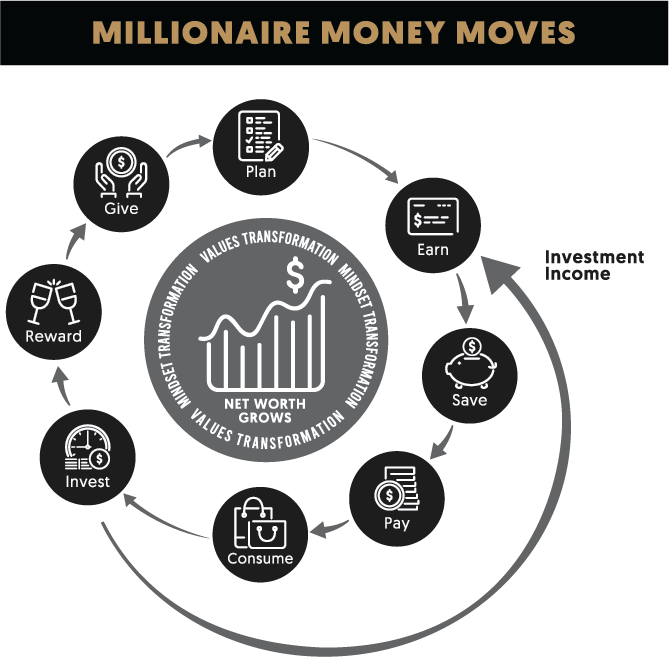

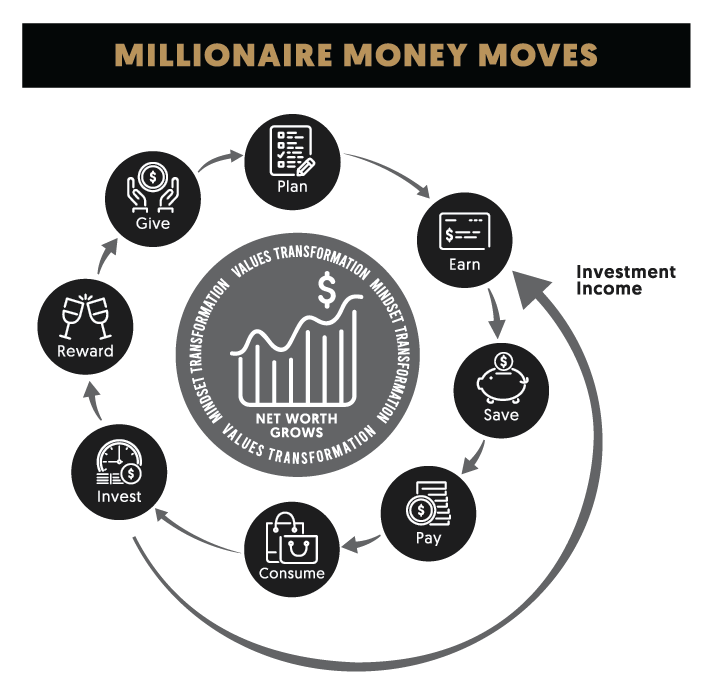

Millionaire Money Moves Framework

My framework was designed to mobilize your finances in a manner that builds wealth. Most personal finance approaches are designed to make you mediocre with your money by only teaching you certain discrete things to do with it. They fail to tie all of the wealth building pieces together into a system that is consistent and repeatable. My M$M framework is instead made up of 8 completely integrated steps: Plan, Earn, Save, Pay, Consume, Invest, Reward, and Give. By performing these steps consistently and repeatedly you’ll be able to achieve any financial aspiration you choose; whether that’s to be financially comfortable or to reach Destination Millionaire and beyond.

Plan

In Plan we determine your starting point, identify your end game, select your paths to Destination Millionaire, draft a budget, and create your Millionaire Money Moves master plan. Your M$M master plan is a fully unified roadmap of how you’re going to earn more, save more, pay down your debt, consume less, invest regularly, reward yourself for achieving your goals, and make a difference by giving back.

Earn

To save more, pay down more debt, and begin to invest it’s imperative you find a way to Earn more. The three areas of your life through which you can earn more are your main hustle (a.k.a. day job), your side hustles, and your investment hustle. It’s essential that the extra money you earn from these sources goes primarily towards building up your capital to invest. Only a small portion of it should go towards accelerated debt pay down because your assets can grow faster and larger, eventually enabling you to pay off 100% of your debt over time as well. The long-term goal in my framework is to get your investments to do all the work so you don’t have to.

Save

Once you earn more, you’re able to Save more. These savings will allow you to build up the capital you need to invest consistently, as well to put away an emergency fund for harder times in the future. Through saving, you’ll also have money with which to systematically reward yourself from time to time for achieving your goals (see Reward section).

Pay

Pay means paying all of your non-discretionary (mandatory) expenditures such as a mortgage, rent, utilities, transportation, health care, food, credit card and loan debts, and so forth. The goal of Pay is to spend the absolute minimum required to live a modest life so you can build investment capital through saving and investing. In this way, your investments can eventually cover what you’re required to Pay and more.

Consume

Consume addresses discretionary (non-mandatory) expenditures like shopping, traveling, eating out, entertainment, and so on. Since these expenses are discretionary and therefore not required, they are the most difficult ones to contain and control. The goal of Consume is to stay at or below the specific percentage level suggested in the Millionaire Money Moves Power Budget, which is explained later.

Invest

Once you build up your savings, you can begin to Invest in income-producing, appreciating assets such as securities (stocks, bonds, and commodities), real estate, entrepreneurship, and alternative investments (angel investing, venture capital investing, hedge funds and private equity). You need to diversify by investing in as many asset classes as possible to hedge against any one sector having an adverse impact on your overall investment portfolio. If you invest consistently over time, your investments will make you a millionaire or multi-millionaire. Your investments will continue to grow and produce more income than you need to support your desired lifestyle. At that point, you will have achieved your endgame, and can choose to continue acquiring more assets or dedicate your time to a greater purpose.

Reward

Everyone enjoys buying themselves something nice from time to time. It’s one of life’s great pleasures. The challenge with buying things for yourself is that it competes with your need to save and invest. My Reward system takes a deferred (as opposed to instant) gratification approach to rewarding yourself. It ties Rewards to the achievement of key milestones in your plan to become a millionaire and beyond. Rewarding yourself based on your achievements not only improves your overall satisfaction, it motivates you to keep progressing.

In your reward plan you’ll list specific items you plan to buy as rewards for accumulating more assets. You can have anything you want (though of course, you can’t have everything). The real catch is that you have to reward yourself responsibly. Only the money you stash away in your Reward fund can be used to pay for your rewards, so you don’t increase your debt level or deplete your savings.

Give

Giving is powerful. Giving has a way of returning to you 10 fold either financially or through doors that are opened up by the contacts you make along the way. In my system, you will create a Give plan that aligns with your overall M$M master plan. This allows you to make your giving impactful in accordance with that which matters most to you. Whether your giving is faith-based, charitable, political, or a gift to friends or family, having a plan makes your giving intentional and increases your level of gratitude and impact.

Some of you may not be in a financial position to give financially. That’s perfectly okay. However, you can always give of your time, which can be equally if not more impactful than giving money. The choice of how you give is a personal one; what matters is that you create a plan to give back in whichever way you desire. Know that, “To whom much is given, much is expected.”

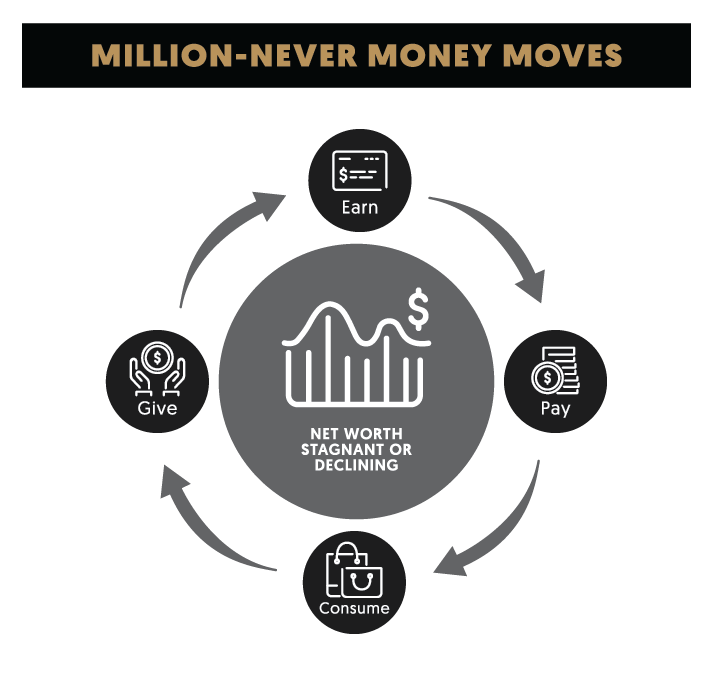

Million-Nevers versus Millionaires

The key objective of my system is to convert million-never behaviors into millionaire ones. This diagram captures the essence of why making millionaire money moves works. Million-Nevers only earn, pay, consume, and give. They never plan, save, invest, nor strategically reward themselves, thereby making it impossible for them to ever build wealth. What’s more, Million-Nevers fail to transform their mindset, money values and behaviors, thus neglecting the work that’s absolutely necessary to consistently make millionaire money moves.

Millionaires and future millionaires either already possess the right mindset and money values or they’re committed to doing the necessary work to transform their mindsets and money values.

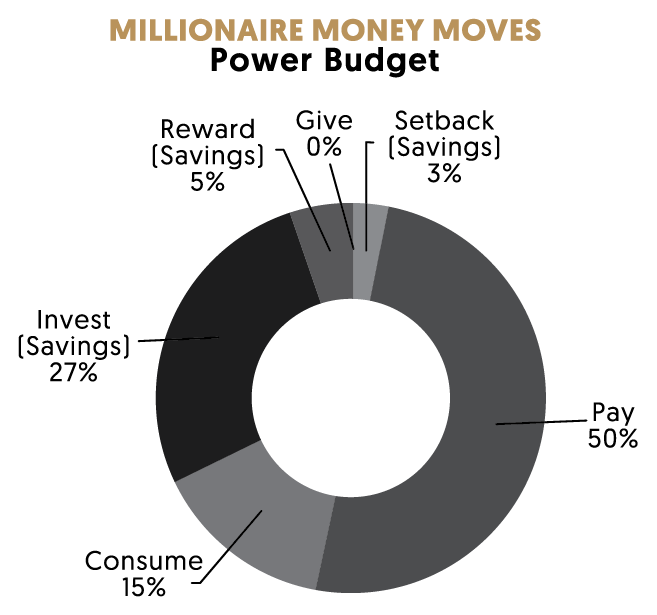

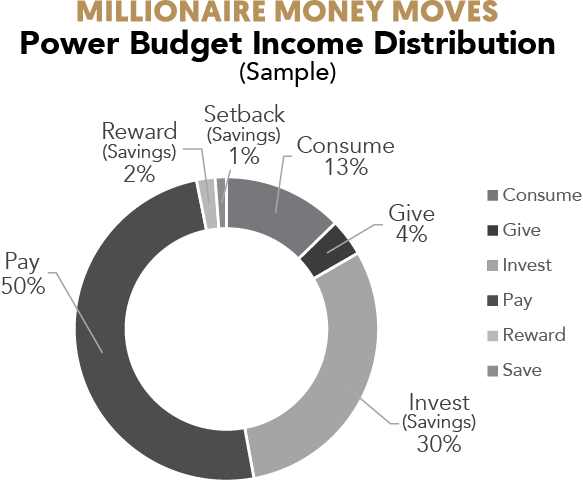

Millionaire Money Moves Power Budget

Some experts suggest you should save 10% of your salary and put it in a 401K for your entire 40-plus year work life. The trouble with that rate is that the math says otherwise. Saving 10% a year means that you’ll have 1 year’s worth of salary for every 10 years of retirement. By that measure, if you were to work for, say, 43 years you’d have just 4.3 years’ worth (i.e. 43 years/10 years =4.3 years) of savings to live on in retirement. Even when taking compounding into account, you still might end up with only 10 years’ worth of savings. Thus if you retire by age 65, and your money will only last 10 years in the best case, you’ll go broke by age 75. You simply must save a higher percentage of your income and invest in several asset classes to acquire the kind of money you’ll need to retire comfortably and throughout your entire retirement life. In other words, you’ll need several millions. That’s what making millionaire money moves is all about - getting you to millions.

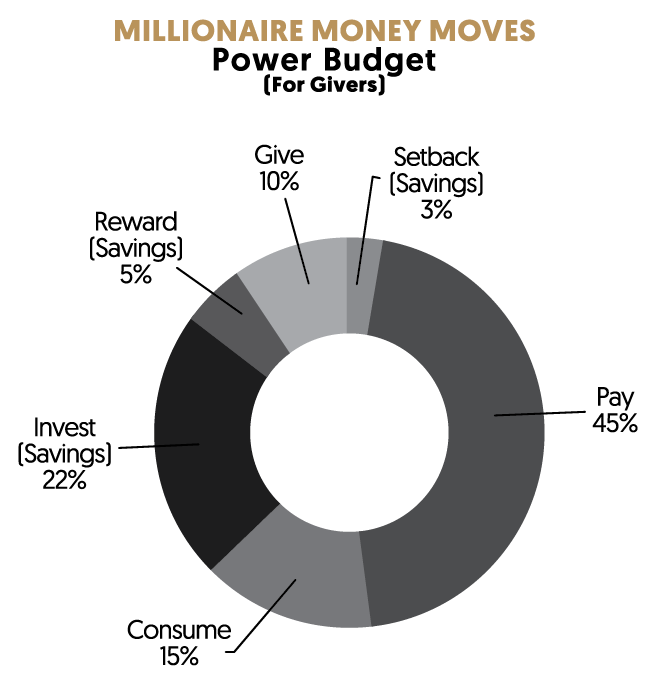

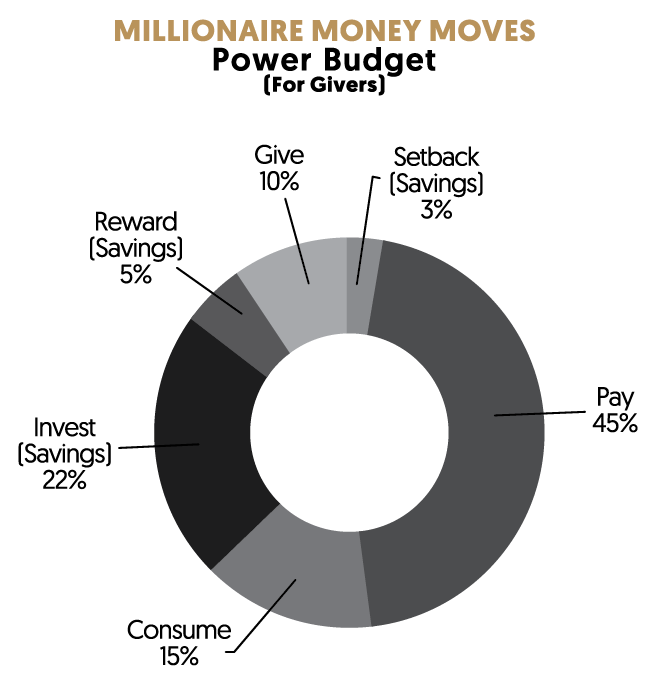

The Millionaire Money Moves Power Budget (For Givers)

The Millionaire Money Moves Power Budget (For Givers) allocates your money across a framework designed to keep you investing. The system requires you to Invest at least 22% of your income across your entire freedom fund savings accounts (401k, IRA, and after-tax investment accounts such as a ROTH IRA, if you qualify for one). Additionally, my system requires that you save 3% in your Setback emergency fund to trickle charge your savings account in case of an emergency. The goal here is to slowly build up to a 12-month emergency fund. However, if an emergency occurs before then, and you have no other means to bail yourself out, you can tap into your freedom fund to do so. My budget also suggests that you set up a Reward savings fund of 5% of your income over time to allow you to buy whatever your heart desires without losing your investment gains in the process. The Pay portion of the budget for givers allocates 45% of your salary for non-discretionary expenses (mortgage, rent, utilities, food, etc.), Consume permits 15% of your salary for lifestyle purchases, while the Give portion allots 10% of your income for your faith based organization, favorite charity, political interests, or friends and family.

Obviously, not everyone is in a position to or wants to give 10% of their income. For that scenario I’ve created a second version of The Millionaire Money Power Budget which you see depicted. The only difference between the two budgets is that the 10% allocated to Give in the “For Givers” budget is re-allocated as follows: 5% additional to your Freedom Fund and 5% additional to the Pay portion of your budget.

By now I’m sure you’re asking “how in the world am I going to save 30%-35% of my income across my freedom fund, setback fund, and reward fund when I can barely save a dollar?” The answer is that you’re going to work your butt off to earn more so you can save and invest more and pay down more debt and you’re going to do it systematically in a way that’s proven to work. Anyone who has ever succeeded financially did so by working harder and smarter than most. That just comes with the territory. So strap in, lace up, and get ready to start making Millionaire Money Moves now!

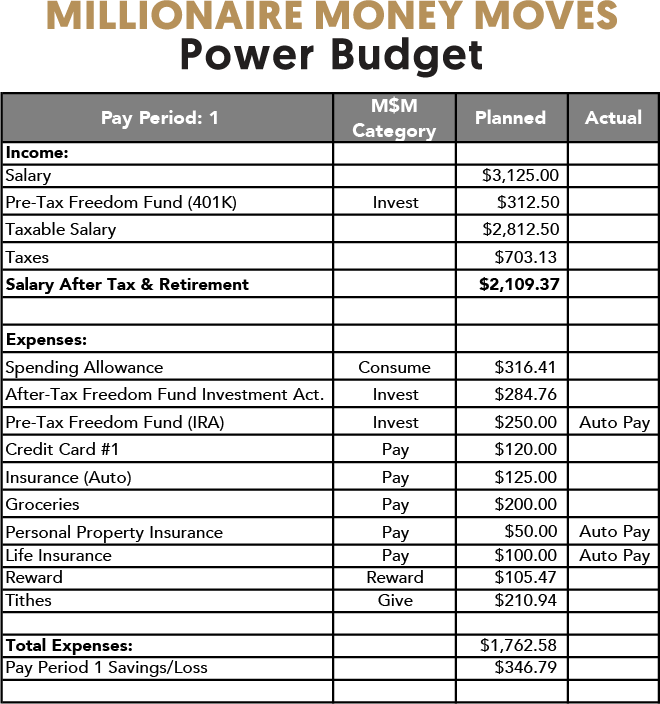

Millionaire Power Budget Planning Template

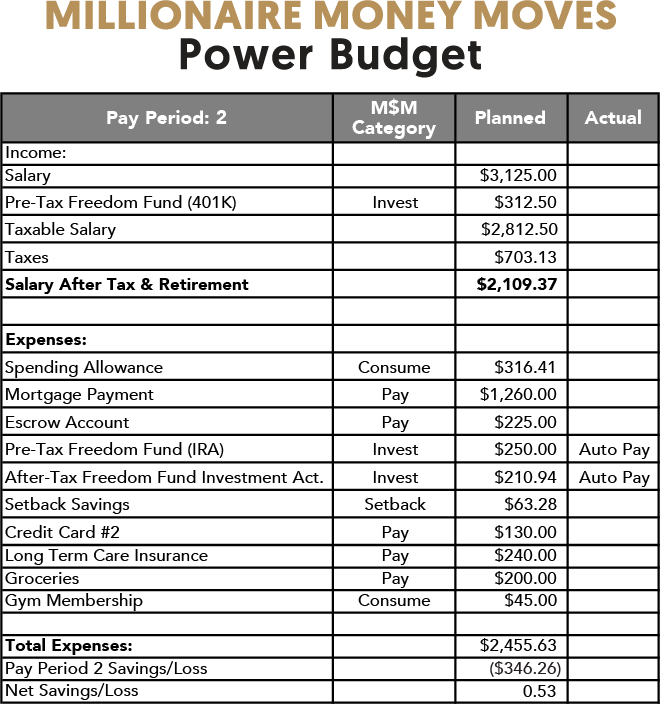

To put the Millionaire Power Budget into practice I have provided a Budget Planning Template. This version of my template is available at www.cedricnash.com. You’ll notice this is not the same version I used in my book because I’ve since found an opportunity to better align the template to my M$M framework.

I’ll admit, I’m old school and I like to specifically plan where my money is allocated to ensure that I can first of all meet all my obligations on time and secondly optimize my budget so I pay as little as possible and save and invest as much as I can.

I have used this budget structure since I began my first job out of college and it’s worked wonders for me. What this template does is allow you to align your bills across two pay periods, assuming that you’re paid twice a month. In my first job, as with many salaried jobs, I got 26 paychecks per year; every two weeks for 12 months plus two extra checks I chose to allocate my expenses across my two-week pay periods, and then twice a year, when I would receive an additional paycheck, I would either save and invest that money, or spend it worry-free. You may decide to plan differently; the choice is yours to make.

My Budget Planning Template is just that, a planning tool. The execution of your budget is where the hard work begins. Money is like air; it tends to seek cracks through which to escape, so it’s important that you track your spending and make realistic adjustments to your plan in order for it to be an accurate reflection of where your money is going and equally important, not going.

In my book, I recommended using one of the leading personal finance apps such as Personal Capital, Empower, YNAB (You Need A Budget), Acorns, Mint.com, PicketGuard, Dollarbird, Mvelopes, Wally, Good Budget, Spendee, or Albert. Take advantage of these tools where it makes sense to help you budget and track your spending.

To stay on budget, I also recommend you open at least 6 accounts. Account 1 is your 401K account where you put pretax money away for retirement. Account 2 is your Investment account where you can stash away after-tax money. Account 3 is your Pay account used to pay your mandatory bills. Account 4 is your Consume Account where you pay for lifestyle items like eating out, entertainment, shopping and so forth. Whenever that account becomes depleted you have to stay at home and stop spending until you get paid and can replenish it again. Account 5 is your Set Back account where your emergency funds are saved and stored. Lastly, Account 6 is your Reward account, where you put money away until you achieve specific goals and can then buy yourself whatever your heart desires.

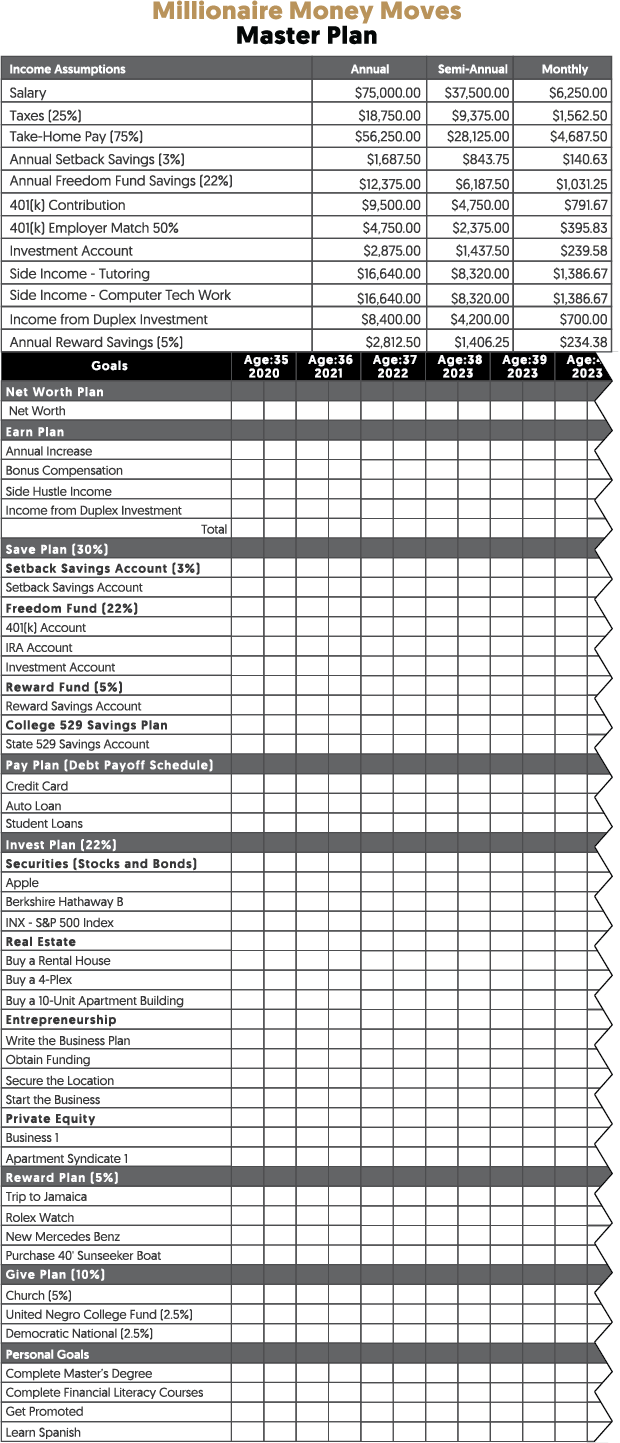

Millionaire Money Moves Master Plan

The Millionaire Money Moves Master Plan is your integrated roadmap for achieving Destination Millionaire and beyond. So many people talk about becoming a millionaire or a billionaire someday yet few of them actually devise a clear plan to get there. Under my system, you will develop your Millionaire Money Moves Master Plan. By creating a master plan everything is strategically planned so that as your net worth/wealth grows and your income and savings increase, debts are paid down, and investment activities are accelerated . At the same time, you’re able to confidently reward yourself while you progress.

Your investment plan is integrated with your savings plan so that the investments in assets that you’ve outlined are made each time you save the required level of capital for each of those investments. This is what makes your M$M master plan realistic, and guarantees that you consistently build wealth. As the value of your assets grows your net worth/level of wealth increases along with it.

Using the free M$M master plan Excel template I’ve provided at www.cedricnash.com you can project out for as many years as necessary. I find that it’s difficult to project beyond 5-10 years though it’s perfectly fine to do so if you wish. After all, this is your plan and you can change it according to whatever you want to achieve.

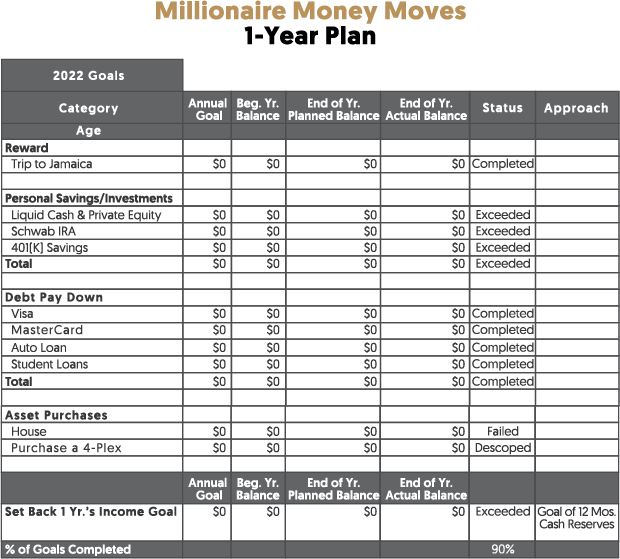

Breaking Your Plan Into Smaller Parts

Creating a plan is one thing though truth be told, executing your plan is everything. One key strategy to successfully execute your Master Plan is to break it down into smaller parts. I find it particularly useful to break my longer-term plans into 1 year plans. This way I can focus on achieving my goals 1 year at a time rather than being overwhelmed with my 5 or 10 year goals. I simply use the Millionaire Money Moves 1-year plan template to outline the things that I want to accomplish in the current year. At the end of each year, I document whether I’ve achieved my goal, exceeded my goal, failed to meet my goal or descoped a goal because I found that it was no longer necessary to achieve, due to poor timing or a host of other reasons, as is sometimes the case. You can always modify your plan but try to avoid modifying your overall goals too much to prevent yourself from creating constantly moving targets that are harder if not impossible to ever achieve.

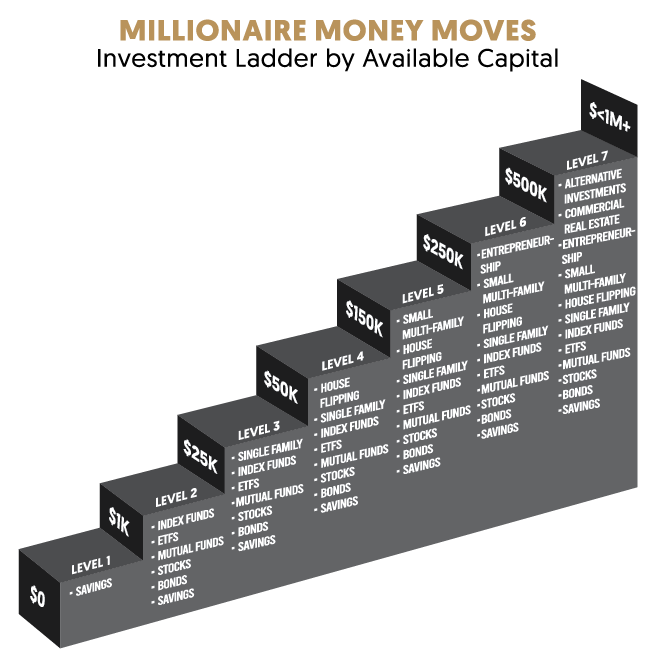

Millionaire Money Moves Investment Ladder

How can you become a millionaire starting from the bottom? Meaning with absolutely nothing at all? The answer is My Millionaire Money Moves Investment Ladder, where the rubber truly meets the road. My investment ladder is an investment pathway to becoming a millionaire starting from the bottom. It shows you where you should invest and what you can invest in as your savings/investment capital grows. There are 7 investor levels on my ladder. The goal is to become a level 7 investor which will mean you’re a millionaire for real. Not only will you be a bona-fide millionaire, your investment portfolio will be adequately diversified so you can confidently remain a millionaire as time goes on.

As you see, the first step in turning yourself into a Level 7 millionaire investor is to reach $1,000 of savings, which is the threshold between Level 1 and Level 2. At that point, you can begin to invest in securities: index funds, Exchange Traded Funds(ETFs), mutual funds, stocks, and bonds.

Later, when your savings reach Level 3, between $25,000 and $50,000, you’ll open yourself up to being able to invest in real estate, either by purchasing a single-family home, vacation property or duplex as your primary residence, or an investment property from which to earn rental income that can then be reinvested.

As you continue to save and move up the investment ladder to Level 4, you’ll be able to add multi-family properties as a way to generate more income and investment capital. When you reach the goal of becoming a Level 7 investor, your portfolio will be well diversified in securities, real estate, entrepreneurship (if you desire), and alternative investments (angel investing, venture capital, hedge funds, and private equity).

For more details on how to use my Millionaire Money Moves Wealth building system, purchase my book Why Should White Guys Have All the Wealth?