Plan

In Plan we determine your starting point, identify your end game, select your paths to Destination Millionaire, draft a budget, and create your Millionaire Money Moves master plan. Your M$M master plan is a fully unified roadmap of how you’re going to earn more, save more, pay down your debt, consume less, invest regularly, reward yourself for achieving your goals, and make a difference by giving back.

Earn

To save more, pay down more debt, and begin to invest it’s imperative you find a way to Earn more. The three areas of your life through which you can earn more are your main hustle (a.k.a. day job), your side hustles, and your investment hustle. It’s essential that the extra money you earn from these sources goes primarily towards building up your capital to invest. Only a small portion of it should go towards accelerated debt pay down because your assets can grow faster and larger and thus in time pay off 100% of your debt. The long-term goal in my framework is to get your investments to do all the work so you don’t have to.

Save

Once you earn more, you’re able to Save more. These savings will allow you to build up the capital you need to invest consistently, as well to put away an emergency fund for harder times in the future. Through saving, you’ll also have money with which to systematically reward yourself from time to time for achieving your goals (see Reward section).

Pay

Pay means paying all of your non-discretionary (mandatory) expenditures such as a mortgage, rent, utilities, transportation, health care, food, credit card and loan debts, and so forth. The goal of Pay is to spend the absolute minimum required to live a modest life so you can build investment capital through saving and investing. In this way, your investments can eventually cover what you’re required to Pay and more.

Consume

Consume addresses discretionary (non-mandatory) expenditures like shopping, traveling, eating out, entertainment, and so on. Since these expenses are discretionary and therefore not required, they are the most difficult ones to contain and control. The goal of Consume is to stay at or below the level suggested in the Millionaire Money Moves Power Budget, which is explained later.

Invest

Once you build up your savings, you can begin to Invest in income-producing, appreciating assets such as securities (stocks, bonds, and commodities), real estate, entrepreneurship, and alternative investments (angel investing, venture capital investing, hedge funds and private equity). You need to diversify by investing in as many asset classes as possible to hedge against any one sector having an adverse impact on your overall investment portfolio. If you invest consistently over time, your investments will make you a millionaire or multi-millionaire. Your investments will continue to grow and produce more income than you need to support your desired lifestyle. At that point, you will have achieved your endgame, and can choose to continue acquiring more assets or dedicate your time to a greater purpose.

Reward

Everyone enjoys buying themself something nice from time to time. It’s one of life’s great pleasures. The challenge with buying things for yourself is that it competes with your need to save and invest. My Reward system takes a deferred (as opposed to an instant) gratification approach to reward yourself. It ties Rewards to the achievement of key milestones in your plan to become a millionaire and beyond. Rewarding yourself based on your achievements not only improves your overall satisfaction but also motivates you to keep progressing.

In your reward plan, you’ll list specific items you plan to buy as rewards for accumulating more assets. You can have anything you want (though of course, you can’t have everything). The real catch is that you have to reward yourself responsibly. Only the money you stash away in your Reward fund can be used to pay for your rewards, so you don’t increase your debt level or deplete your savings.

Give

Giving is powerful. Giving has a way of returning to you 10 fold either financially or through doors that are opened up by the contacts you make along the way. In my system, you will create a Give plan that aligns with your overall M$M master plan. This allows you to make your giving impactful in accordance with that which matters most to you. Whether your giving is faith-based, charitable, political, or a gift to friends or family, having a plan makes your giving intentional and increases your level of gratitude and impact.

Some of you may not be in a financial position to give financially. That’s perfectly okay. However, you can always give of your time, which can be equally if not more impactful than giving money. The choice of how you give is a personal one; what matters is that you create a plan to give back in whichever way you desire. Know that “To whom much is given, much is expected.”

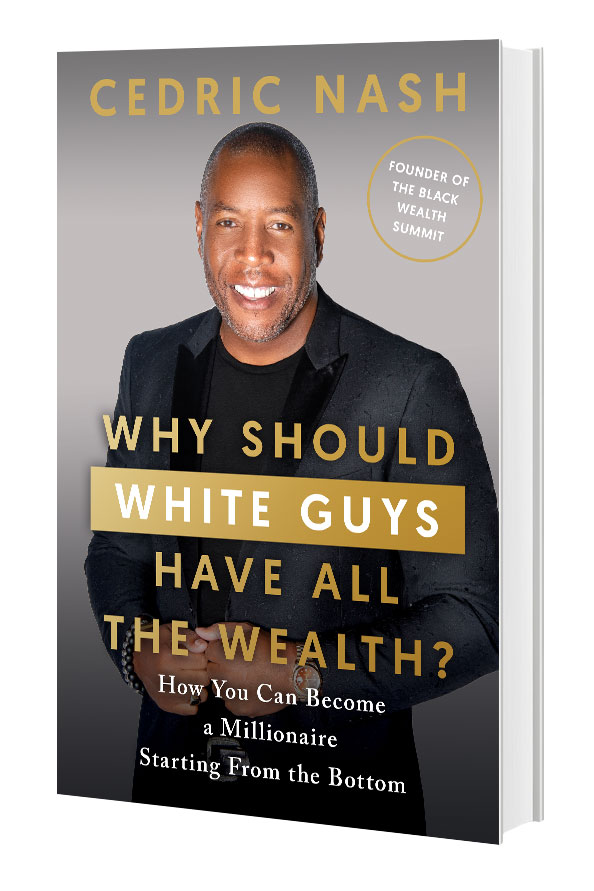

WHY SHOULD WHITE GUYS HAVE ALL THE WEALTH?

Why Should White Guys Have All the Wealth? digs into why you find it hard to do what you need to do with your money to become a millionaire and shows you how to push past it. Yes, there’s tons of information on personal finance, but Nash’s M$M wealth-building system integrates the steps you need to develop the right mindset, adopt the right values, and make the right money moves. Designed to make you a millionaire, it will mobilize your financial state even if you’re starting from the bottom. Learn how to take what you have and earn more so you can invest in securities, real estate, entrepreneurship, and alternative investments that will build real wealth and lifelong income for yourself and future generations. Through stories, humor, and real-world grit, you’ll feel like you’re spending a casual afternoon with your favorite uncle or mentor who happens to be a multi-millionaire and wants to help you become one too.